American lawmakers are visiting South Korea and Japan to explore how the U.S. can collaborate with these nations—both global leaders in shipbuilding—to expand and modernize its naval support fleet. The goal is to address growing concerns over the U.S. Navy’s limited shipbuilding capacity, especially when compared to China’s rapidly expanding maritime capabilities.

Senators Tammy Duckworth (D-Illinois) and Andy Kim (D-New Jersey) are set to arrive in Seoul before heading to Japan. During the visit, they plan to meet with top shipbuilders from the world’s second- and third-largest shipbuilding countries. Their focus is on forming joint ventures for constructing and repairing noncombatant support vessels for the U.S. Navy and Army in the Indo-Pacific region. These efforts may also bring fresh investment into American shipyards.

“We have even less capacity now than we did during Operation Iraqi Freedom in 2003,” said Duckworth. “We need to rebuild shipbuilding capacity, especially as existing vessels are aging and becoming more costly and time-consuming to maintain.”

The trip aligns with broader efforts in Washington to revitalize American shipyards. President Donald Trump has pushed for a renewed plan to strengthen U.S. shipbuilding, including leveraging foreign expertise. The Pentagon is requesting $47 billion in its current shipbuilding budget to narrow the gap with China, which is now the world’s largest shipbuilder.

Duckworth, who serves on the Senate Armed Services Committee, hopes that this visit will lead to cooperation between the U.S. military, American shipyards, and overseas companies to develop auxiliary vessels—such as cargo and refueling ships—for military support operations. Another area of focus is overseas maintenance, to avoid delays caused by transporting ships back to the U.S. for repairs.

“If ships have to be sent all the way back home for repairs that take two years, it’s just not practical,” she added.

Auxiliary vessels are critical to naval and military logistics but are currently aging and limited in number. According to a 2024 study by the Center for Strategic and International Studies, U.S. commercial shipbuilding made up just 0.1% of global production, while China accounted for 53%, followed by South Korea and Japan. A Navy review in April 2024 also revealed that several major U.S. shipbuilding projects were behind schedule by one to three years.

During their trip, the senators will meet with executives from leading shipbuilders in the region. South Korea is already showing signs of deepening cooperation with the U.S. In March, Hanwha Ocean completed maintenance work on the USNS Wally Schirra, a 41,000-ton dry cargo and ammunition ship—its first such project under a repair agreement signed with the U.S. Navy in July 2024.

Hanwha Group also acquired Philly Shipyard in Philadelphia last year, which builds large merchant ships used in the reserve auxiliary fleet. Additionally, South Korea recently proposed investing $150 billion in the U.S. shipbuilding industry as part of trade negotiations, supporting Trump’s “Make American Shipbuilding Great Again” initiative.

Duckworth mentioned prior talks with Hyundai Heavy Industries about the possibility of them investing in American shipyards on U.S. soil.

Meanwhile, China has further strengthened its dominance by merging two state-owned enterprises to form the China State Shipbuilding Corporation. This new entity produces a range of naval vessels, including aircraft carriers and nuclear submarines, and now controls 21.5% of the global shipbuilding market.

Also Read:

Export Ban Imposed by China on Taiwan Military-Connected Businesses

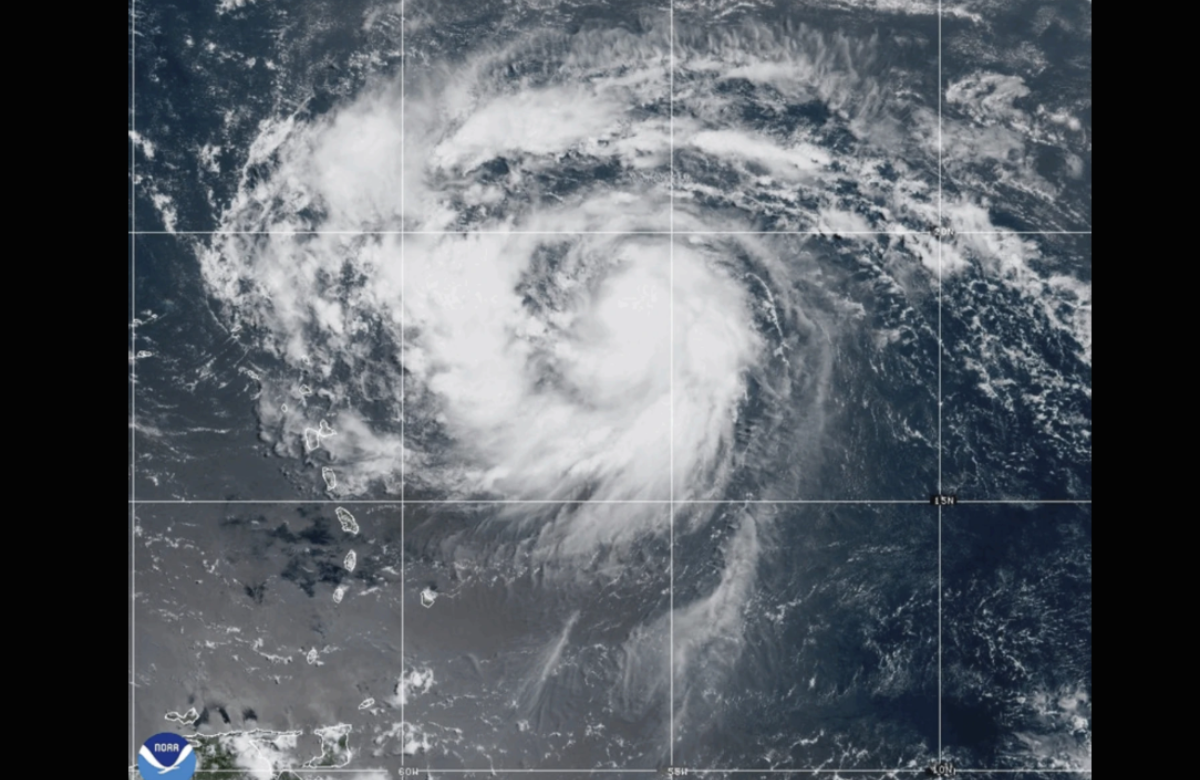

Tropical Storm Podul Hits Southeastern China, Bringing Heavy Rainfall