The U.S. Treasury has opted not to classify China as a currency manipulator in its latest foreign exchange policy report, but it criticized Beijing for its lack of transparency in managing its exchange rate—calling it an outlier among America’s key trading partners.

Released Thursday, the Treasury’s semi-annual “Macroeconomic and Foreign Exchange Policies of Major Trading Partners of the United States” report arrives as the Trump administration works to reach a trade agreement with China and prevent a full-scale trade war.

While the report stopped short of formal accusations, Treasury officials said the U.S. may still determine later this year that China is manipulating its currency. A decision could come as early as fall, depending on developments in China’s management of the renminbi (RMB).

China was last officially labeled a currency manipulator by the U.S. in 2019 during Trump’s first term, under then-Treasury Secretary Steve Mnuchin. Prior to that, China hadn’t received that designation since 1994.

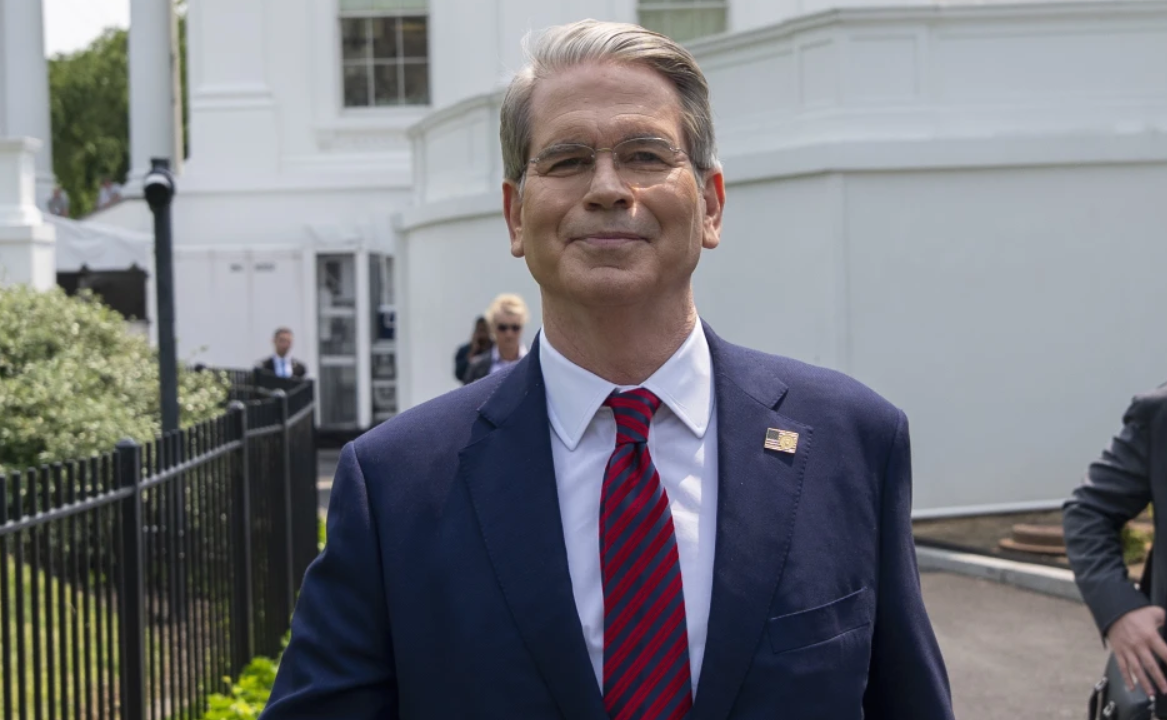

Current Treasury Secretary Scott Bessent said the administration has made it clear that it will not tolerate trade imbalances created by macroeconomic policies of other nations. “We’ve put our trading partners on notice—unfair currency practices that lead to unbalanced trade with the United States won’t be accepted,” Bessent said. He also emphasized that the U.S. is prepared to take strong action using all tools at its disposal to combat such practices.

The decision not to impose sanctions or issue a formal currency manipulation label comes just as Trump revealed he had a “very positive” call with Chinese President Xi Jinping—the first conversation between the two leaders since Trump returned to office. Trump said the hour-and-a-half-long discussion opened the door for renewed trade negotiations, with both sides agreeing to meet soon at a yet-to-be-determined location.

As a gesture of goodwill, Trump has temporarily lowered tariffs on Chinese imports from 145% to 30% for a 90-day negotiation window. China, in turn, reduced tariffs on U.S. goods from 125% to 10%. These moves signal an easing of trade tensions, though recent back-and-forth actions have continued to cause volatility in global markets and uncertainty around the future of U.S.-China trade, especially concerning rare earth mineral supplies and broader tariff impacts.