Britain’s highest court largely reversed a lower court’s judgment that certain hire-purchase agreements for cars were unlawful, a decision that will likely bring relief to lenders and significantly reduce potential compensation claims.

A panel of five Supreme Court judges ruled in favor of lenders on two out of three key issues, determining that they are generally not responsible for undisclosed commission payments made to car dealers.

As a result, lenders are expected to avoid paying compensation to millions of customers who entered into car finance plans—deals that industry analysts estimated could have led to tens of billions of pounds in payouts.

The judges stated, “No reasonable observer would think that by offering to find a suitable finance package to enable the customer to obtain the car, the dealer was giving up, rather than continuing to pursue, its own commercial interest in making a profitable sale.”

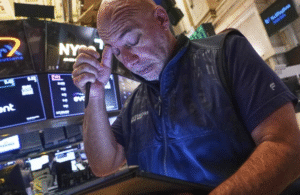

The court issued its decision after the stock markets had closed to prevent any disorderly trading in shares of companies connected to the car finance industry.

This ruling is likely to be welcomed by the financial sector, which has been shaken by a string of scandals over the last decade, particularly related to the mis-selling of payment protection insurance (PPI) on loans.

Previously, in October, the Court of Appeal had found that three motorists—who bought their cars before 2021—were not adequately informed that dealers, acting as credit brokers, received commissions from lenders for referring business. That ruling had suggested the customers should receive compensation.

Two lenders, FirstRand Bank and Close Brothers, challenged that decision at the Supreme Court, arguing during a three-day hearing in April that the Court of Appeal had made a “serious error.” The Financial Conduct Authority, the industry’s regulator, also told the Supreme Court that the previous ruling “went too far.”

Also Read:

Starmer and Modi Celebrate Landmark India-UK Trade Agreement as Historic Breakthrough

Wall Street Tumbles and Bond Yields Drop Amid Disappointing Job Data and Fresh Tariff Moves