Nvidia reported a significant increase in its fourth-quarter profit and sales on Wednesday, driven by strong demand for its specialized Blackwell chips, which power artificial intelligence systems. This growth boosted the company’s stock after hours.

For the quarter ending January 26, the tech company based in Santa Clara, California, posted revenue of $39.3 billion, marking a 12% increase from the previous quarter and a 78% jump from the same period last year. After adjustments for one-time items, Nvidia earned 89 cents per share.

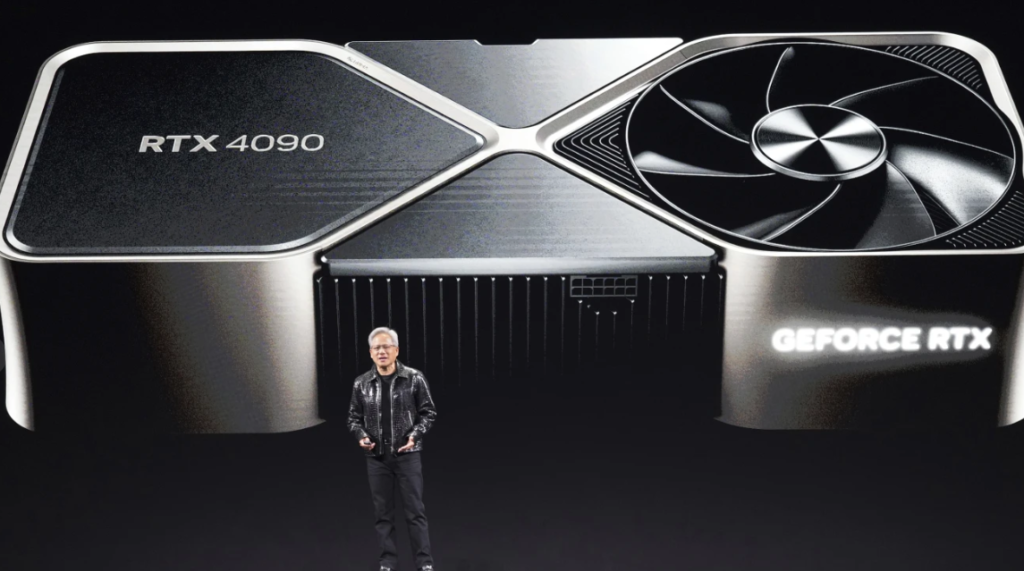

Nvidia Founder Jensen Huang emphasized the remarkable demand for Blackwell chips, explaining that the growing need for reasoning AI and increased computing power for training and long-term decision-making makes AI models smarter.

Huang also mentioned that Nvidia has significantly ramped up production of Blackwell AI supercomputers, achieving billions of dollars in sales within its first quarter of production.

Nvidia’s founder, Jensen Huang, stated that AI is advancing at an incredible pace, with agentic AI and physical AI laying the groundwork for the next wave of innovation that will transform major industries.

The company’s earnings report for Wednesday exceeded Wall Street’s expectations. Analysts had predicted adjusted earnings of 85 cents per share and revenue of $38.1 billion. Instead, Nvidia posted net income of $22.06 billion for the fourth quarter, surpassing analysts’ expectations of $19.57 billion. Nvidia also forecast continued growth, projecting first-quarter revenue for fiscal 2026 to be around $43 billion.

Data center sales, which make up a significant portion of Nvidia’s revenue, played a major role in the company’s growth. In the fourth quarter, data center revenue reached $35.6 billion, marking a 93% increase compared to the previous year.

This surge in the data center market comes amid discussions by former President Donald Trump about a joint venture that could invest up to $500 billion in AI infrastructure. The new partnership, involving OpenAI, Oracle, and SoftBank, will focus on developing data centers and the energy resources needed to advance AI. Nvidia is a partner in this initiative, known as the Stargate project.

During an earnings call on Wednesday, Nvidia’s Chief Financial Officer Colette Kress announced that fourth-quarter sales of the Blackwell architecture had exceeded the company’s expectations.

“We achieved $11 billion in Blackwell architecture revenue in the fourth quarter of fiscal 2025, marking the fastest product ramp in our company’s history,” Kress said. “Sales were driven by large cloud service providers, which accounted for about 50% of our data center revenue.”

As a leading force in the AI boom, Nvidia has risen to become the second-largest company on Wall Street, now valued at over $3 trillion. The movement of its stock has a significant impact on the S&P 500 and other major indexes, second only to Apple. Just two years ago, Nvidia’s market value was under $600 billion.

Nvidia, along with other companies benefiting from the AI boom, has been a major contributor to the recent surge in the S&P 500, which has reached new record highs. Their skyrocketing profits have helped drive the market’s growth, despite concerns over persistent inflation and potential challenges to the U.S. economy from tariffs and other policies under President Donald Trump.

Kress acknowledged that the tariffs remain uncertain until Nvidia gains a clearer understanding of the Trump administration’s plans. “We are awaiting further clarity,” she said, emphasizing that the company would comply with any export controls or tariff regulations.

This earnings report is Nvidia’s first since Chinese company DeepSeek claimed to have developed a large language model capable of competing with ChatGPT and other U.S. counterparts. DeepSeek’s model, however, is noted for being more cost-effective in its use of Nvidia chips to train on massive datasets.

The excitement surrounding DeepSeek briefly wiped out $595 billion in Nvidia’s market value. In response, Nvidia issued a statement recognizing DeepSeek’s achievement as “an excellent AI advancement” that uses “widely-available models and compute fully compliant with export controls.”

During Wednesday’s earnings call, Nvidia’s founder Jensen Huang commented on DeepSeek R1, calling it “an excellent innovation” and noting that it has sparked global interest. He highlighted that many AI developers are now adopting R1 and similar techniques to enhance their models’ performance.

Looking ahead, Huang spoke about the “next wave” of AI, which includes agentic AI for enterprise, physical AI for robotics, and sovereign AI as regions develop their own AI ecosystems. “We’re at the heart of much of this development,” Huang added.