Nvidia has made history, becoming the first publicly traded company to cross a $4 trillion market valuation on Wednesday. The milestone reflects the massive wave of enthusiasm surrounding artificial intelligence, a sector where Nvidia leads with its high-performance processors.

This surge in value underscores how AI is reshaping the tech industry, drawing comparisons to the revolutionary launch of the iPhone 18 years ago. While Apple once led the market through the smartphone era—becoming the first to hit $1 trillion, $2 trillion, and later $3 trillion in valuation—Nvidia has now overtaken it by roughly $900 billion.

In contrast, Apple has recently struggled to integrate advanced AI features into its products. Its virtual assistant, Siri, remains underwhelming, and the company acknowledged last month that its broader AI goals won’t materialize until sometime next year. This delay has led some analysts to speculate that Apple may need to acquire an AI-focused startup to keep pace.

Meanwhile, Jony Ive, Apple’s former design chief, has teamed up with OpenAI to develop a new AI-powered wearable device—potentially setting the stage for a direct challenge to the iPhone. At the same time, Nvidia is racing to meet the explosive demand for its chips, which are crucial to powering AI data centers.

Major tech players—Microsoft, Amazon, Alphabet (Google’s parent), and Meta (Facebook’s parent)—are investing heavily in AI this year, with around $325 billion budgeted collectively. Much of that spending is expected to benefit Nvidia directly.

The company’s stock has soared, increasing tenfold since early 2023. Back then, Nvidia was valued around $400 billion; now it’s reached the $4 trillion mark. Although shares dipped slightly in the afternoon, bringing the valuation just under $4 trillion, Nvidia’s stock remained strong at about $163 per share.

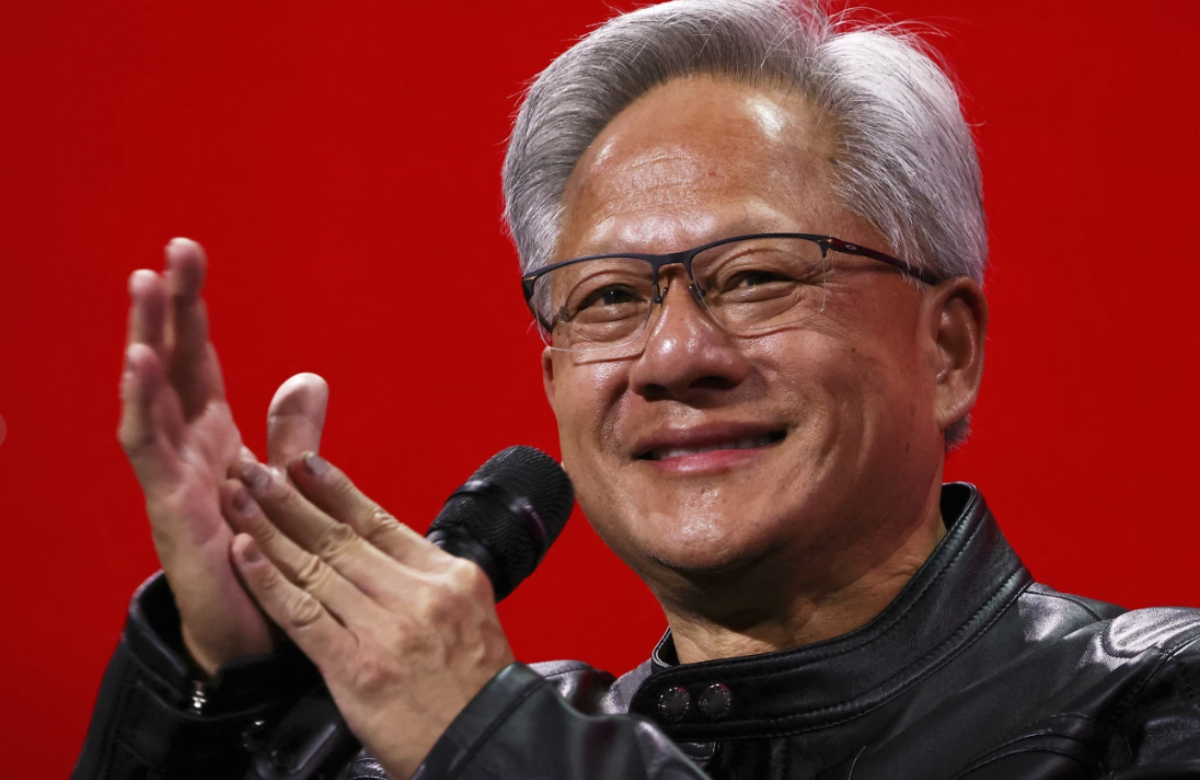

Nvidia’s rise has also elevated its CEO and founder, Jensen Huang, to celebrity status in the tech world. Often referred to as the “godfather” of AI, Huang now commands global attention when speaking about the future of the technology—and his personal fortune has climbed to an estimated $142 billion.

In April, Nvidia briefly faced turbulence when President Donald Trump announced sweeping tariffs, causing a broad market selloff that affected tech stocks. Nvidia’s share price fell below $87 at its lowest point. However, the company rebounded quickly, delivering a remarkable quarterly report in May that included $18.8 billion in profit—even after absorbing a $4.5 billion hit due to U.S. export restrictions on certain chips sold to China.

Based in Santa Clara, California, Nvidia will release its next earnings report on August 27.

Also Read:

Nvidia to Exclude China from Future Forecasts Due to U.S. Chip Export Restrictions, CEO Confirms

US court blocks many of Trump’s tariffs, Nvidia drives Wall Street rally higher