Nvidia will no longer factor China into its revenue and profit projections due to ongoing U.S. export restrictions on chip sales, the company’s CEO Jensen Huang said Thursday.

Speaking with CNN in Paris, Huang addressed whether trade discussions in London might lead to a relaxation of U.S. controls. “I’m not counting on it, but if it happens, then it will be a great bonus,” he said. “I’ve told all of our investors and shareholders that, going forward, our forecasts will not include the China market.”

In recent years, the U.S. has tightened restrictions on the transfer of chip technology to China in an effort to prevent American innovation from being used to enhance China’s military and AI capabilities.

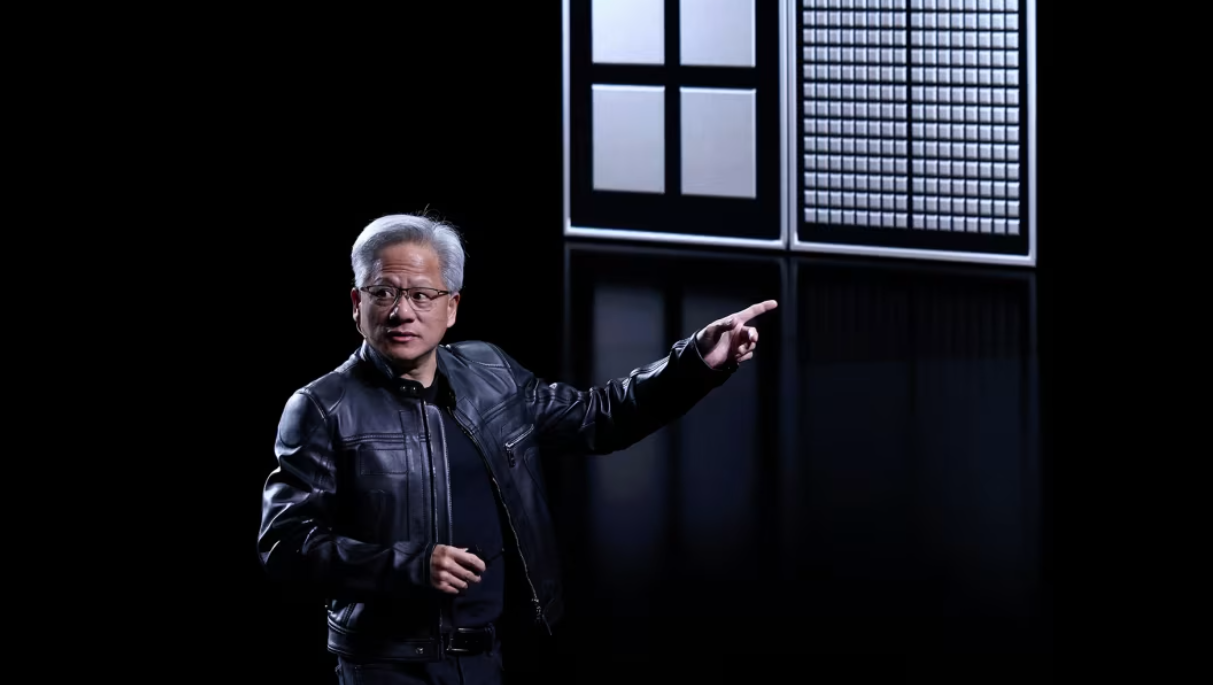

Huang’s remarks highlight how these curbs are affecting Nvidia, which transitioned from a graphics card manufacturer for gaming into a major player in the artificial intelligence chip sector. The company recently exceeded Wall Street expectations for its fiscal first quarter of 2025, reporting a 69% year-over-year revenue increase.

Still, Nvidia missed out on $2.5 billion in additional revenue due to export controls that blocked shipments of its H20 AI chips to China. The H20 chip was designed to comply with the current U.S. restrictions, but Nvidia was informed in April that a special license would be required for exports. The company absorbed a $4.5 billion inventory charge—less than the $5.5 billion it had initially expected.

Earlier this week, Kevin Hassett, director of the U.S. National Economic Council, told CNBC that the Trump administration may consider easing restrictions on certain chips vital to China’s manufacturing sector. However, he emphasized that high-end Nvidia AI chips would remain tightly controlled due to their potential national security implications.

Huang reiterated his criticism of the current export policy, stating, “The goals of the export controls are not being achieved. Whatever those goals were initially, they don’t appear to be working. These kinds of policies need clear objectives and regular review.”

Last month in Taiwan, Huang called the chip export restrictions a “failure,” suggesting they’ve harmed U.S. businesses more than they’ve impacted China.

Nvidia’s central role in AI chip supply has placed it at the heart of U.S.-China tech tensions, particularly after the emergence of DeepSeek, a Chinese startup with a reportedly affordable yet capable AI model. The U.S. government, seeking to maintain leadership in AI, has expressed concerns about overregulating the industry. Vice President JD Vance remarked at the Artificial Intelligence Action Summit in Paris that overly restrictive rules could hinder the industry’s growth.

Tech analyst Dan Ives of Wedbush Securities noted that loosening the export curbs could be essential to prevent China from gaining ground in AI development. “The current H20 ban is essentially handing part of Nvidia’s business over to Huawei,” he wrote in a recent note.

Despite these challenges, Nvidia continues to grow. Huang announced that the company will build the world’s first industrial AI-focused cloud computing platform in Europe. He also revealed that Nvidia’s new Blackwell architecture will be used to power major AI infrastructure projects across the continent.