Stocks rose on Wall Street Thursday afternoon, with major indexes hovering near all-time highs, boosted by strong performances from major technology companies.

The S&P 500 climbed 0.5%, sitting just above its previous record set earlier in the week. The Nasdaq surged 0.9%, putting it on track for a new high as well. The Dow Jones Industrial Average was little changed by midday.

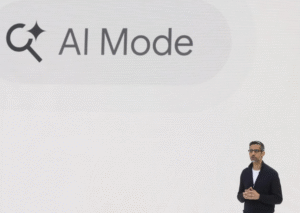

Tech stocks were the main driver of Thursday’s rally, propelled by upbeat earnings and optimism surrounding artificial intelligence. Meta Platforms, the parent company of Facebook and Instagram, jumped 12.2% after beating Wall Street’s expectations for both revenue and earnings. The company is heavily investing in AI, a strategy that appears to be paying off.

Microsoft shares rose 4.6% after also reporting better-than-expected results. Investors were particularly encouraged by positive news about its Azure cloud computing platform, a key piece of the company’s AI push.

Investors are also awaiting earnings reports from Apple and Amazon, which are scheduled to be released after the market closes. These tech giants have played a significant role in the stock market’s growth, largely due to investor confidence in the future of artificial intelligence.

Outside of tech, corporate earnings remain in focus. CVS Health gained 1.6% after surpassing earnings forecasts for the second quarter and raising its full-year outlook for the second time.

Markets were also responding to fresh economic data, particularly on inflation. The Commerce Department reported that the personal consumption expenditures (PCE) index—a key inflation measure tracked by the Federal Reserve—rose 2.6% in June compared to a year earlier. That’s slightly above expectations and up from 2.4% in May, signaling persistent inflation above the Fed’s 2% target.

Another government inflation indicator, the consumer price index (CPI), also showed a rise in June. Meanwhile, new unemployment data showed jobless claims ticking slightly higher last week.

The inflation outlook remains clouded by ongoing uncertainty around tariffs. Several companies, including Ford and Hershey, have recently warned that tariffs are impacting their performance and future projections.

President Donald Trump has indicated that he may impose tariffs on products from numerous countries unless trade agreements are reached by Friday. In recent developments, there has been talk of a possible pause in tariff hikes with China and a trade agreement with South Korea.

Trump’s trade strategy remains unpredictable. On Wednesday, he signed an executive order to impose a 50% tariff on imports from Brazil, citing a connection to the trial of former Brazilian president Jair Bolsonaro, a close ally. He also suggested Canada’s diplomatic move to recognize a Palestinian state could complicate trade negotiations.

The uncertainty around trade and inflation has influenced the Federal Reserve’s decision to keep interest rates unchanged through its last five meetings. While inflation is close to target levels, it remains slightly elevated, prompting the central bank to hold back on rate cuts.

Cutting rates could stimulate the economy but might also risk fueling inflation. Fed Chair Jerome Powell continues to face pressure from Trump to lower rates, though such decisions rest with the 12-member Federal Open Market Committee.

“With inflation expected to rise in the second half of the year due to tariffs, and the job market still strong, the Fed appears comfortable keeping rates steady for now,” said Bill Adams, chief economist at Comerica Bank.

Investor expectations for a rate cut at the Fed’s September meeting are declining. According to CME Group, the odds of a rate cut have fallen to 39.2%, down from 58.4% a week ago and 75.4% a month ago.

In the bond market, yields dipped slightly. The 10-year Treasury yield slipped to 4.34% from 4.37%, and the two-year Treasury yield fell to 3.92% from 3.94%.

Globally, stock markets were mixed across Asia and Europe.

Also Read:

Wall Street Pulls Back Slightly from Record Highs as a Busy Week Gathers Pace

U.S. Stocks Head Toward Strong Finish After Record-Breaking Week