Hawaii lawmakers have approved groundbreaking legislation aimed at addressing climate change and environmental degradation by increasing the state’s lodging tax. The bill, which is expected to be signed by Governor Josh Green, adds a 0.75% surcharge to the existing tax on hotel rooms, vacation rentals, timeshares, and other short-term accommodations. It also introduces an 11% tax on cruise ship bills, adjusted based on how many days the ships dock in Hawaii.

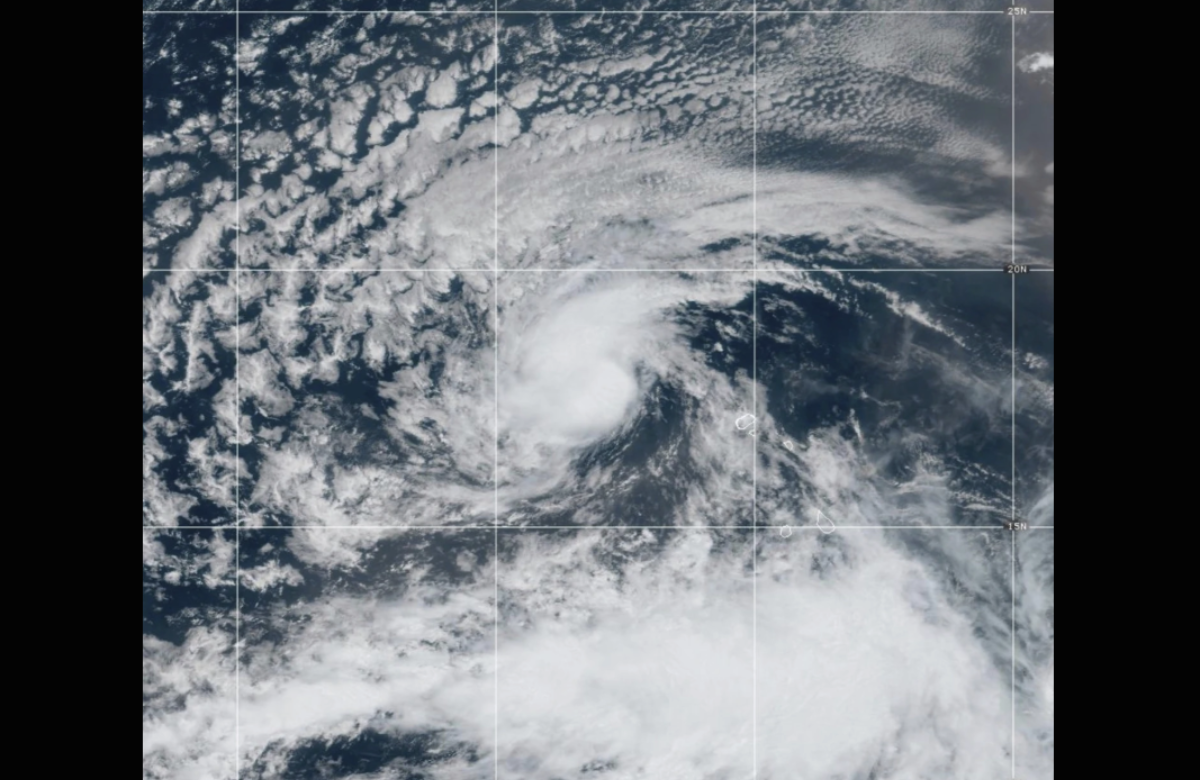

The initiative is expected to generate nearly $100 million annually, with all new revenue specifically earmarked for climate-related projects. These include replenishing eroded sand at Waikiki Beach, improving storm resilience with roof-secure hurricane clips, and removing highly flammable invasive grasses — such as those that fueled the devastating Lahaina wildfire in 2023.

This legislation marks the first time a U.S. state has implemented a lodging tax solely to support environmental efforts and climate resilience. Both chambers of Hawaii’s Democrat-led legislature passed the bill with strong support.

Currently, Hawaii charges a 10.25% tax on short-term stays. As of January 1, that rate will rise to 11%, with counties adding their own 3% lodging tax and a 4.712% general excise tax also applied. This brings the total tax burden on visitors to about 18.712%, one of the highest in the country.

Governor Green believes the increase is modest enough not to deter most visitors. He noted that many people travel to Hawaii to enjoy its natural beauty and will likely appreciate efforts to preserve it. “Investing in our environment can encourage lifelong loyalty from travelers,” he said.

It’s important to note that only the newly added 0.75% tax and the cruise ship levy will be directed toward environmental and climate initiatives. The existing lodging tax revenue will continue to support the state’s general fund and infrastructure projects, such as the Honolulu rail system.

Some visitors, like Chicago resident Zane Edleman, say that the added cost could make travelers consider other destinations such as Florida. However, he emphasized that transparency about how the money is used could make a big difference. “If people can clearly see the environmental benefits, they might be more willing to accept the higher cost,” he said.

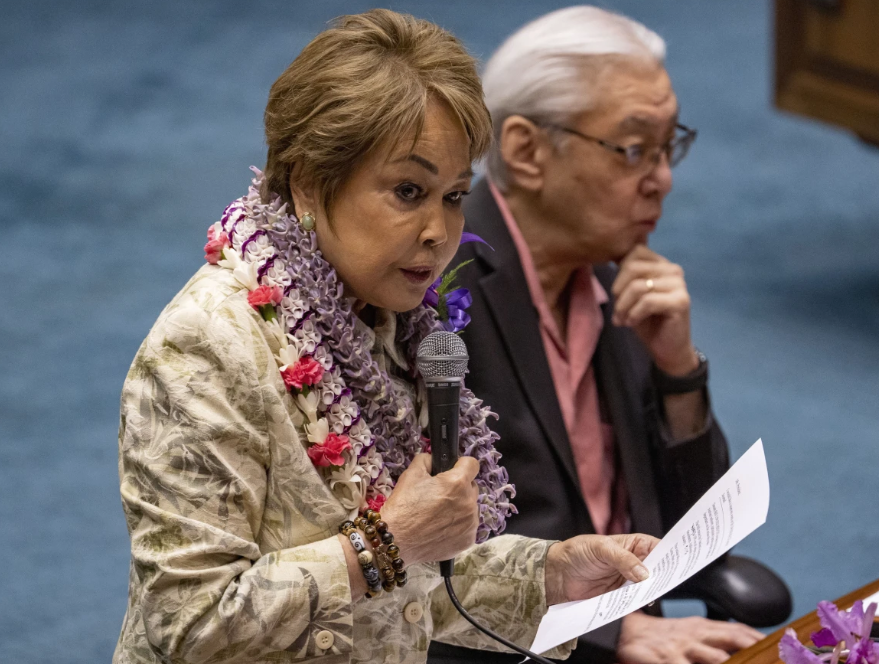

Earlier drafts of the bill had called for steeper increases, but lawmakers adjusted it after hearing concerns from the tourism industry. “We wanted to strike a balance between supporting environmental sustainability and keeping our tourism industry competitive,” said House Vice Speaker Linda Ichiyama.

While the tourism sector generally agrees that the goals of the tax are worthwhile, some worry about long-term consequences. John Pele, head of the Maui Hotel and Lodging Association, acknowledged the importance of the funding but raised a critical question: “Will we end up pricing tourists out of coming here? That remains to be seen.”