CareMax, a major healthcare provider that operates 56 medical centers in Florida, Texas, Tennessee and New York, filed for Chapter 11 bankruptcy in a Texas court on Sunday.

The Miami- based company, which provides services primarily to elderly patients, has $690 million in debt and $390 million in assets, according to a filing with the U.S. Bankruptcy Court in the Northern District of Texas.

In August, the company announced a loss of $170 million in its second quarter report. Along with this, the company warned of financial crisis and said that due to lack of funds, it will not be possible to submit the third quarter report to the US Securities and Exchange Commission.

According to a statement released on Sunday, CareMax plans to sell its management services and main centers. The company said it will continue to operate its clinics on a regular basis and pay the salaries of doctors and nurses.

Caremax has appointed Alvarez & Marcel as financial advisor and Piper Sandler as investment banker in connection with the bankruptcy.

Earlier, Massachusetts- based Steward Health Care Co. also filed for bankruptcy in May. He aimed to sell his 31 hospitals and pay off $9 billion in debt.

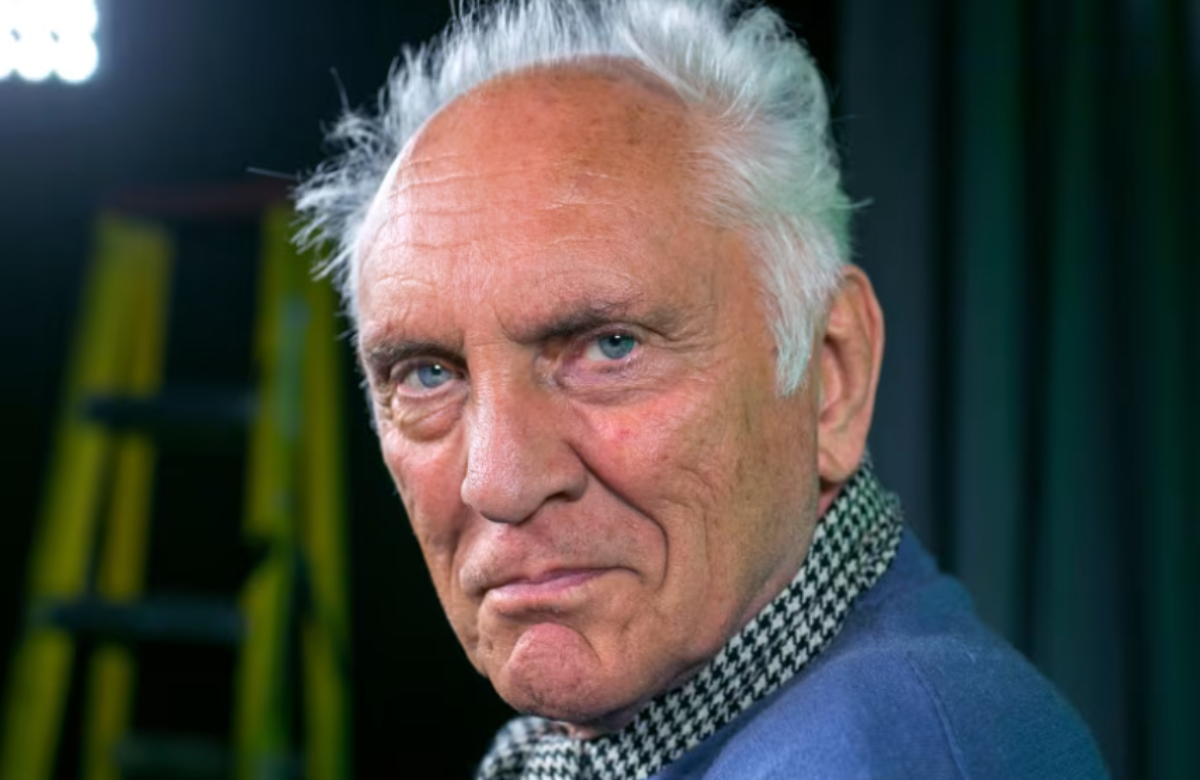

Steward’s CEO Ralph de la Torre was widely criticized for his behavior. It was alleged that he took a salary of over $100 million and bought a yacht worth $40 million. At the same time, the staff of the steward hospitals complained about the lack of basic facilities.

In September, the US Senate Committee on Health, Education, Labor and Pensions approved a motion to impeach De La Torre in contempt of court. Earlier, he had rejected the summons issued in September.

The financial crisis of these major companies in the healthcare sector has created a situation of uncertainty in front of the concerned patients and employees.