Asian stocks rose early Monday, and bitcoin hit a record high ahead of President-elect Donald Trump’s inauguration. U.S. markets were closed for the holiday.

Bitcoin’s price surged to as much as $109,134, up from $99,563. Cryptocurrencies have seen significant growth since Trump’s election, with investors speculating on his potential support for digital assets.

European markets also saw gains in early trading. Britain’s FTSE 100 rose by 0.1% to 8,515.80, the CAC 40 in Paris increased by 0.2% to 7,729.06, and Germany’s DAX remained nearly flat at 20,902.00. Futures for the S&P 500 and Dow Jones Industrial Average both edged up by 0.1%.

In Asia, Hong Kong’s Hang Seng index jumped 1.8% to 19,925.81 after China’s central bank kept its key lending rates unchanged. The Shanghai Composite saw a slight rise of 0.1%, reaching 3,244.38. A Hong Kong court has extended the deadline for struggling property developer Country Garden to finalize an agreement with its creditors until next month. This marks the latest small move toward recovery as the company continues to navigate the ongoing downturn in China’s real estate sector.

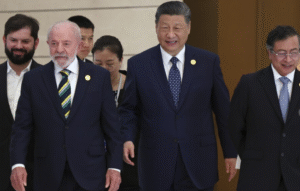

Sentiment was lifted by positive remarks from U.S. and Chinese officials ahead of President-elect Trump’s inauguration later Monday. Both sides expressed a commitment to improving relations, which helped ease concerns over trade tensions, especially as businesses prepare for potential tariff hikes on Chinese exports to the U.S.

In Japan, the Nikkei 225 index rose 1.2% to 38,902.50. The dollar weakened against the yen, trading at 156.17 yen, down from 156.31 yen. There are growing expectations that Japan’s central bank may raise its key interest rate in an upcoming meeting, which could strengthen the yen. The euro gained slightly, rising to $1.0309 from $1.0281.

In South Korea, the Kospi dipped 0.1% to 2,520.05, while Australia’s S&P/ASX 200 increased by 0.5% to 8,347.40. Taiwan’s Taiex index rose 0.5%, and India’s Sensex gained 0.7%. In Bangkok, the SET index increased by 0.1%.

In other early Monday trading, U.S. benchmark crude oil dropped by 19 cents to $77.20 per barrel, while Brent crude, the international benchmark, fell by 23 cents to $80.56 per barrel.

On Friday, the S&P 500 climbed 1%, the Dow gained 0.8%, and the Nasdaq composite surged 1.5%.

SLB led the market after the oilfield services company reported better-than-expected profits and revenues for the end of 2024. Its stock rose 6.1% after it raised its dividend by 3.6% and announced it would return $2.3 billion to investors through stock buybacks.

All the major “Magnificent Seven” tech companies—Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla—saw gains. These tech giants have a significant influence on the S&P 500 and other indexes due to their large market capitalization.

However, these shares have recently faced pressure due to concerns that their prices may have become too inflated after leading the market for several years. These concerns grew after Treasury yields rose in the bond market, as higher yields generally reduce the appeal of expensive stocks.

Stocks received a boost this week following a positive U.S. inflation report, which raised expectations that the Federal Reserve may implement further interest rate cuts this year. Additional rate cuts, which started in September, could stimulate the economy and push investment prices higher, though they could also contribute to rising inflation.

Wall Street has been fluctuating recently as economic reports have caused traders to adjust their forecasts regarding the Fed’s future actions on rates. Reduced concerns about inflation have led to lower Treasury yields and rising stock prices, while increased fears about inflation have had the opposite effect, pushing yields up and stock prices down.