U.S. stocks hovered near record highs on Wednesday following an encouraging inflation report suggesting that President Donald Trump’s tariffs have yet to significantly increase consumer prices.

The S&P 500 dipped slightly by 0.1% in afternoon trading, now just 1.8% below its all-time high set in February. Meanwhile, the Dow Jones Industrial Average gained 94 points, or 0.2%, and the Nasdaq composite rose by 0.2%.

Bond markets saw more activity, with Treasury yields declining after data showed inflation was lower than expected. Consumer prices in May were 2.4% higher than a year earlier—slightly up from April’s 2.3%, but still below Wall Street’s forecast of 2.5%.

Investors had been worried that the Trump administration’s broad tariffs might fuel another spike in inflation, especially after it had fallen from a peak above 9% to closer to the Federal Reserve’s 2% target. While that hasn’t materialized yet, experts caution the full effects of tariffs may take more time to show up. For now, many businesses appear to be relying on existing inventory rather than immediately passing along increased costs from new imports.

“Another month goes by with little evidence of tariff-driven inflation, but the longer-term risks still exist,” said Ellen Zentner, chief economic strategist at Morgan Stanley Wealth Management.

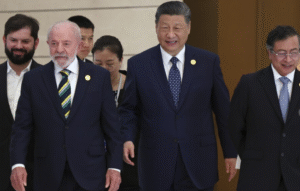

Markets showed limited reaction to the conclusion of two days of U.S.-China trade talks held in London. President Trump stated that China has agreed to supply the U.S. with rare-earth minerals and magnets, while the U.S. will allow Chinese students to study at American universities. He added that both sides are aiming to “open up China to American trade,” which he described as a potential “great WIN” for both nations.

Investors remain optimistic for a broader trade agreement that could ease ongoing tensions between the two largest global economies. Expectations for trade deals—especially between the U.S. and several nations—have helped fuel a recovery in the S&P 500, which had fallen nearly 20% in recent months.

Without those agreements, however, concerns persist that high tariffs could slow the economy and drive up inflation simultaneously.

On the corporate front, Chewy shares dropped 9.3% after reporting quarterly earnings that missed analyst expectations. This was a setback, especially as the pet supply retailer had already gained nearly 37% earlier in the year.

Tesla provided some market support, rising 1.7% as it continued to recover from a steep decline the previous week. That slump had followed tension between Elon Musk and Trump, which sparked fears over potential damage to Tesla’s business. On Wednesday, Musk softened some of his earlier statements, admitting they “went too far.”

In the bond market, the yield on the 10-year Treasury note fell to 4.43% from 4.47% the day before. Shorter-term yields, which more closely reflect expectations for Federal Reserve policy, also declined.

The better-than-expected inflation numbers increased speculation that the Fed might cut interest rates twice before the end of the year. So far in 2025, the Fed has held rates steady, having paused after cutting them at the end of last year. Policymakers have been cautious, waiting to assess the inflationary impact of tariffs, since lowering rates could risk pushing inflation higher.

“There’s now a strong case for the Fed to consider preemptive rate cuts,” said Brian Jacobsen, chief economist at Annex Wealth Management. “They were worried inflation would spike before growth slowed, but now it looks like the opposite is happening.”

Globally, stock markets were mixed. European indexes mostly declined, while Asian markets showed gains. South Korea’s Kospi led the way in Asia with a 1.2% increase.